: 2. How is wealth distributed in Germany?

Private wealth in Germany is very unequally distributed. What is known as the Gini coefficient for wealth was 0.76 in 2014. In the Eurozone only Lithuania has a higher figure (ECB 2017). The closer the coefficient is to 1, the greater the unequal distribution and the greater the concentration of wealth among few rich people.

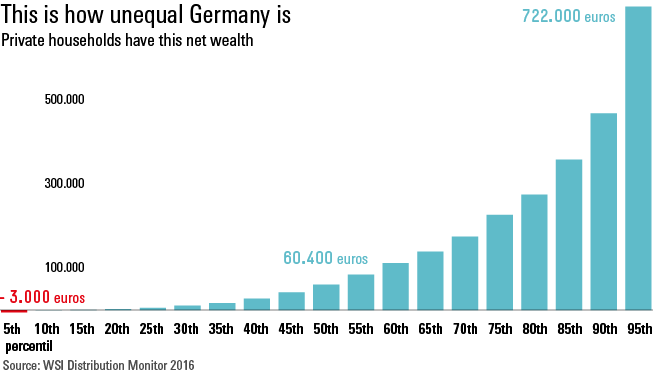

Altogether the wealthiest ten per cent of households together own about 60 per cent of the total wealth, net, i.e. minus debts. The lower 20 per cent have no assets at all. About nine per cent of all households have negative equity and are in debt (Grabka and Westermeier 2014).

According to the Bundesbank, average net wealth was 214,500 euros in 2014. The median of net wealth was, however, markedly lower. The median is precise-ly the value in the middle when households are divided into a richer and a poorer half. In 2014 the wealth of the household in the middle of the distribution was 60,400 euros net (see graph: 50th percentile). The large difference between average and median wealth is an indicator of high inequality.

Anyone with assets in excess of 722,000 euros belongs to the upper five per cent in Germany. Assets include tangible assets such as property, companies, jewellery and cars, as well as financial assets including securities, stocks and shares. Debts like mortgages and loans are deducted from the assets.

The figures quoted are based on conservative estimates; the true extent of inequality could be even greater. Ultimately, large and very large assets are under-recorded in most statistics – the random samples are frequently based on voluntary surveys, in which multimillionaires and billionaires do not usually take part.

To what extent wealth inequality is underestimated is shown by a German Institute for Economic Research study (Westermeier and Grabka 2015) funded by the Hans Böckler Foundation: the study incorporates additional information from rich lists, such as the Forbes List. According to this estimate, the total net wealth of private households in Germany is two to three billion euros more than generally assumed. So the richest per cent of households would own roughly one third of total wealth – and not just one fifth, as worked out using traditional methods. There are no official data on the wealth of the superrich, as wealth tax has been abolished.

References

Deutsche Bundesbank: Vermögen und Finanzen privater Haushalte in Deutschland: Ergebnisse der Vermögensbefragung 2014 (pdf), Monatsbericht der Deutschen Bundesbank 2016

EZB. The Household Finance and Consumption Survey – Wave 2. Statistical tables. EZB April 2017.

Grabka, Markus M., Westermeier, Christian: Anhaltend hohe Vermögensungleichheit in Deutschland (pdf), DIW-Wochenbericht 9/2014

Grabka, M.M:, Westermeier, C.: Große statistische Unsicherheit beim Anteil der Top-Vermögenden in Deutschland (pdf), DIW-Wochenbericht 7/2015