: 9. What could be done to reduce inequality?

Politicians and social partners could do something effective on many different levels.

Education: Free or state-funded access to early childhood education, as well as to institutions of higher education, is a key element for guaranteeing equal opportunities and enabling social mobility (Corak 2013).

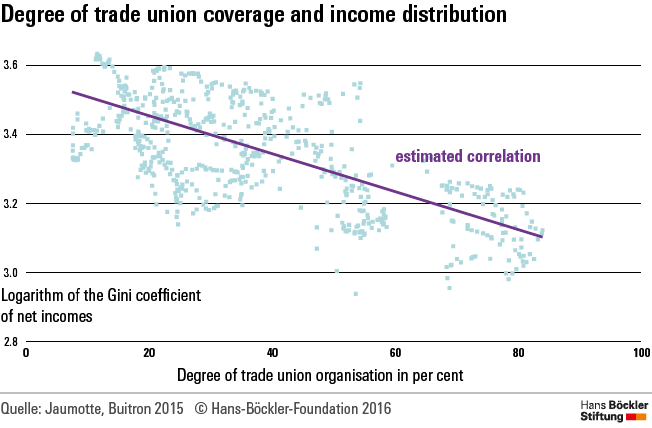

Level of trade union organisation: According to International Monetary Fund researchers (IMF; Jaumotte and Buitron 2015), income inequality is rising as the influence of trade unions is waning. In addition to workers’ dwindling bargaining power, this is also attributable to strong trade unions using their political influence to demand a redistributive welfare state. Consequently, strengthening the degree of trade union organisation should have an inequality-reducing effect.

Minimum wage: A statutory minimum wage can also help reduce inequality without triggering off negative employment effects, as often feared. However, as the Jaumotte and Buitron study (2015) shows, it is also important to adjust the minimum wage regularly to the development of average incomes. Other-wise, people drawing the minimum wage could fall behind the general trend in wages, and income inequality would increase.

Progressive taxation: Most income categories are subject to progressive income taxation, with high incomes incurring a higher average rate of tax. Capital gains, on the other hand, are taxed uniformly at a rate of 25 per cent. Compared to that, the top tax rate is considerably higher at 45 per cent. If capital gains, which are particularly concentrated in the hands of top earners, were taxed as previously in line with other types of income, they would be subject to higher taxation. Such a synthetic income tax on capital gains was very recently brought up for discussion by Finance Minister Wolfgang Schäuble. However, income tax has also experienced a marked decline in progressiveness since the 1980s. Whereas in 1981 the OECD average of top income tax rates was still 66 per cent, in 2010 the average was only 42 per cent (Förster et al. 2014). This has substantially weakened the redistribution effect of the tax system. Additional revenue through more progressive taxes enables higher spending on education, for instance.

Tax avoidance and tax evasion: The Panama Papers, the “cum/ex trades” and patent boxes are just three recent cases of tax avoidance and tax evasion that play their part in a more unequal distribution of income and wealth. A more effective taxation of these gains and this wealth, on the other hand, would help reduce inequality. Expert estimates put the total loss for the German public treasury arising from tax avoidance and tax evasion at about 50 billion euros a year.

Wealth tax and inheritance tax: Since wealth is still substantially more unequally distributed than income and also plays a part in income inequality through interest income, a wealth tax concentrated on considerable wealth can help reduce inequality (Bach and Thiemann 2016). More progressive taxation of unearned income such as inheritances is a key element in promoting equal opportunities and social mobility (Piketty et al. 2013). This is not a question of “grandma’s cottage”, which does not incur inheritance tax owing to the customary tax-free allowances. However, relief provisions for the inheritance of business assets, concentrated in the hands of the wealthiest, produce effectively lower taxation precisely of large inheritances (Bach et al. 2010). With a stretched tax burden over several years it is likely that the continued existence of companies will hardly be put at risk by inheritance tax, so there is no valid reason for the relief (Rietzler et al. 2016). Among the developed economies, Germany has relatively low taxation of wealth and inheritances.

Pension system: In recent years the pay-as-you-go, jointly financed proportion of the German pension system has been weakened in several stages, whereas the capital-funded private system has been encouraged. What is more, compared to other countries like Austria, only workers are compulsorily insured, whilst the (usually higher-earning) self-employed and civil servants have their own pension schemes. The net replacement rate of the pay-as-you-go system, i.e. the proportion of the net pension in the pay of an average earner, is just 50 per cent. Compared with other countries, that figure is very low (in Austria the net replacement rate is 92 per cent (cf. Blank et al 2016). However, it is precisely poorer people who often lack the financial means for private old-age pension in spite of state funding. A jointly financed pay-as-you-go system, into which all earned incomes are paid in, could therefore help considerably reduce the impending spread of poverty in old age.

References

Bach, S., Thiemann, A. 2016. Hohes Aufkommenspotential bei Wiedererhebung der Vermögensteuer, DIW Wochenbericht 4/2016.

Bach, S., Beznoska, M., Steiner, V. 2010. Aufkommens- und Verteilungswirkungen einer Grünen Vermögensabgabe. Forschungsprojekt im Auftrag der Bundestagsfraktion BÜNDNIS 90/DIE GRÜNEN, DIW Berlin: Politikberatung kompakt Nr. 59.

Blank, F., Logeay, C., Türk, E., Wöss, J., Zwiener, R. 2016. Österreichs Alterssicherung: Vorbild für Deutschland? Wirtschaftsdienst 96(4), 279-286.

Corak, M. 2013. Income Inequality, Equality of Opportunity, and Intergenerational Mobility, Journal of Economic Perspectives, 27(3):79-102.

Förster, M., Llena-Nozal, A., Nafilyan, V. 2014. Trends in Top Incomes and their Taxation in OECD Countries. OECD Social, Employment and Migration Working Papers, No. 159.

Jaumotte, F., Buitron, C. O. 2015. Inequality and Labor Market Institutions. IMF Staff Discussion Note, Nr. SDN/15/14.

Piketty, T., Saez, E., Zucman, G. 2013. Rethinking capital and wealth taxation. Mimeo.

Rietzler, K., Scholz, B., Teichmann, D., Truger, A. 2016. IMK Steuerschätzung 2016-2020 (pdf) IMK Report 114.